Your investment in an apprentice or trainee

Keeping up to date on current legislation, award, tax and superannuation requirements is no easy task.

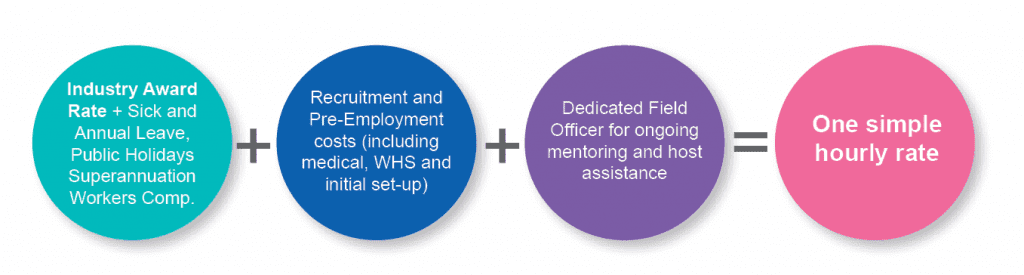

Novaskill keeps things simple.

When you’re looking at employing an apprentice, you’ve got more to worry about than ensuring you’re up to date with all the legislation, awards, superannuation and tax requirements. Taking on an Apprentice through Novaskill allows you to access some the best talent without the headache of recruiting and paying them yourself.

Running a business is stressful but employing apprentices doesn’t have to be.

You may also be eligible for potential tax deductions!

Generally a fee paid to a GTO in order to obtain the services of an apprentice or trainee to work in the host employer’s business is an allowable deduction to the employer under section 8-1 of the ITAA 1997. The essential character of the expenditure is of a revenue nature and there is an objective commercial explanation for the whole of the expenditure. For more information about potential tax deductions for your business, please contact your accountant.

For a personalised quote for your business and industry, please leave your details.

Oops! We could not locate your form.